Imagine you’re about to climb a towering mountain. The view from the top promises to be breathtaking, but the climb itself is daunting. To help you feel secure, you use a safety line.

This line ensures you won’t fall far if you slip and can easily regain your footing. The safety line gives you the confidence to keep climbing, knowing you have a safety net to catch you.

This is the essence of risk reversal in business. It’s like providing a safety line to your customers, offering them protection and reassurance.

By applying strategies such as money-back guarantees, free trials, or easy returns, you’re giving your customers the confidence to make a purchase, knowing they have a safety net if things don’t go as planned.

Implementing risk reversal tactics on your small business website can significantly boost conversions, though figuring out the initial steps can be challenging. Identifying where to start is crucial to understanding the concept of risk reversal. So, what exactly does it entail?

What is a Risk Reversal?

Risk reversal is a powerful strategy that shifts the burden of risk from the buyer to the seller. By utilizing this technique, your business commits to rectifying any issues if your buyer’s expectations aren’t met.

This means your target buyer can confidently make a purchase, knowing that you will take responsibility if they are not satisfied.

The Psychology Behind Risk Reversal

The psychology behind risk reversal lies in its ability to alleviate the potential buyer’s fear of making a bad decision. By removing or reducing the perceived risk, you create a sense of security and trust, lowering the psychological barrier to making a purchase.

This technique reassures your target buyers that they won’t face negative consequences, effectively neutralizing the fear of loss that often hinders decision-making. Additionally, it demonstrates your confidence in your offer, further enhancing credibility.

When your target customers feel protected and valued, they are much more likely to proceed with confidence and commit to the purchase.

Why is Risk Reversal Important?

When executed effectively, risk reversal can offer several compelling advantages:

- Increased Sales and Conversions: By alleviating the buyer’s concerns, risk reversal can significantly boost sales and conversions. Your ideal customers are more likely to purchase when they feel secure and protected from potential losses.

- Enhanced Customer Trust and Loyalty: Offering a risk-free guarantee shows you are confident in your offer. This builds trust with customers, encouraging long-term loyalty and repeat business.

- Competitive Advantage: In a crowded market, a strong risk reversal policy can set your business apart from your competitors. Customers tend to prefer sellers who offer a safety net over those who do not.

- Improved Customer Satisfaction: Promising to address any problems can lead to higher customer satisfaction. Happy customers are more likely to give positive reviews and refer your business to others.

- Reduced Perceived Risk: A well-designed risk reversal strategy reduces the perceived risk of a purchase. This psychological reassurance can be a powerful incentive, prompting reluctant customers to take action.

- Positive Brand Image: Businesses that back their products with guarantees are often seen more favorably. This positive perception can enhance your brand image and reputation in the market.

- Lower Return Rates: Surprisingly, offering a risk reversal guarantee can lead to fewer returns. When customers are aware of their fallback option, they often feel more confident and pleased with their purchase, reducing the likelihood of exercising the return option.

Strategically implementing risk reversal can help you boost your conversions and build a stronger, more trusting relationship with your customers, leading to long-term success.

However, overlooking this strategic approach can lead to unfavorable outcomes.

The Pitfalls of Poorly Executed Risk Reversal

Without strategic implementation, risk reversal can have detrimental effects on your business such as:

- Financial Losses: If the terms of a risk reversal are too lenient or unclear, you may experience significant financial losses from returns, refunds, or exchanges. This could diminish profits and harm your business’s financial performance.

- Customer Exploitation: A poorly designed risk reversal policy may be exploited by customers who take advantage of the guarantee without legitimate concerns. This can lead to more fraudulent claims, driving up expenses and administrative burdens.

- Damaged Reputation: Failure to fulfill risk reversal promises or mishandling claims can harm your business’s reputation. Negative feedback and bad reviews can damage the brand and deter potential customers.

- Operational Strain: Dealing with a high volume of returns, refunds, or exchanges can strain a company’s operational capabilities, resulting in delays, inefficiencies, and increased labor expenses that disrupt everyday business operations.

- Confusion and Misunderstanding: Ambiguous or overly complicated risk reversal terms can confuse customers, leading to dissatisfaction and disputes. It’s important to have clear, straightforward policies to prevent misunderstandings and maintain customer trust

- Reduced Perceived Value: Offering overly generous risk reversal policies might inadvertently signal to customers that the offer is of lower quality or that the business lacks confidence in its offerings. This could lower the perceived value and appeal of the product.

- Market Positioning Issues: If our competitors do not offer similar guarantees, an overly generous risk reversal policy could potentially place you at a competitive disadvantage, as it may not align with industry standards or customer expectations.

Successful implementation of a risk reversal strategy requires careful planning, clear and honest communication, and effective management to avoid pitfalls and maximize benefits.

Risk Reversal Best Practices:

To maximize the effectiveness of your risk reversal option strategy, apply these crucial best practices:

1. Deliver What You Promise

Whether it’s a full refund, a better-than-risk-free guarantee, or other forms of risk mitigation, make sure your assurances are clear and reliable. The goal is to build trust and confidence by delivering on your commitments consistently.

2. Be Clear and Specific

Providing clarity and specificity in a guarantee allows your target buyers to fully understand what they can get or lose once they decide whether they should buy or not.

3. Use Future Pacing

Highlighting how your offer can positively impact the lives of potential buyers is crucial. By vividly describing the benefits and outcomes they can expect after purchase, you help them envision a better future.

Paint a picture of how their life could improve significantly—whether it’s achieving healthier hair, financial security, or peace of mind.

Ultimately, this future pacing technique emphasizes that not buying your offer could mean missing out on these transformative benefits. It shifts the perspective to show that choosing your offering is a proactive step toward a better future, persuading them to make a purchase.

4. Address Your Target Audience’s Concerns

To create a persuasive risk reversal strategy, thoroughly consider the objections your ideal buyers might have that could prevent them from purchasing your offer. Ask yourself:

- Financial Obstacles:

- What are the primary concerns potential customers may have about the effectiveness or reliability of our offering?

- How can we alleviate fears related to the initial cost or financial commitment?

- Practical Considerations:

- Are there doubts about the ease of use or integration of our solution into their existing processes?

- Emotional Barriers:

- What emotional barriers might deter them from taking action, such as fear of change or uncertainty about outcomes?

- How can we provide evidence or testimonials to reassure them of our product’s benefits and reliability?

By addressing these concerns preemptively and transparently in your risk reversal strategy, you can build trust and confidence, ultimately encouraging ideal customers to choose your offering over competitors.

5. Extend the Refund Window

When you extend the refund window beyond industry standards, you reassure potential customers of your confidence in your product’s efficacy. This longer period allows them ample time to fully evaluate and experience the benefits without feeling rushed.

Such a gesture not only reduces perceived risk but also enhances the perceived value of your offering. Clear and transparent communication about the extended refund policy is essential to foster trust and credibility. Ultimately, this strategy can differentiate your product in a competitive market and encourage hesitant buyers to make a purchase, knowing they have a generous safety net if needed.

6. Ensure Your Guarantees Are Genuine and Customer-Friendly

Authenticity is key in crafting effective risk reversal guarantees. Customers are quick to recognize insincerity or overly restrictive terms. Ensure that your guarantees align with your brand’s values and capabilities, avoiding promises that could strain your resources or disappoint customers.

By keeping your guarantees customer-centric and realistic, you maintain credibility and build long-term relationships based on trust.

Example of a guarantee that is not customer-friendly:

“Refunds available within 30 days with proof of purchase. All returns are subject to a 20% restocking fee and must be in original packaging.”

Example of a genuine and customer-friendly guarantee:

“Love our organic skincare products or your money back, guaranteed. If you’re not completely satisfied within 60 days of purchase, simply contact our customer service team for a full refund, no questions asked.”

7. Test to Find the Most Compelling Guarantees

Continual testing of different guarantee structures and messaging is crucial to optimizing your risk reversal strategy. By A/B testing variations in refund policies, wording of assurances, and the visibility of guarantees, you can gather valuable insights into what resonates most with your offer.

This iterative approach helps refine your strategy based on real-world feedback and enhances the overall effectiveness of your risk reversal offers. Aim to gather data on conversion rates, customer feedback, and any changes in perceived trust or satisfaction to inform future adjustments and ensure your guarantees remain compelling and competitive in the marketplace.

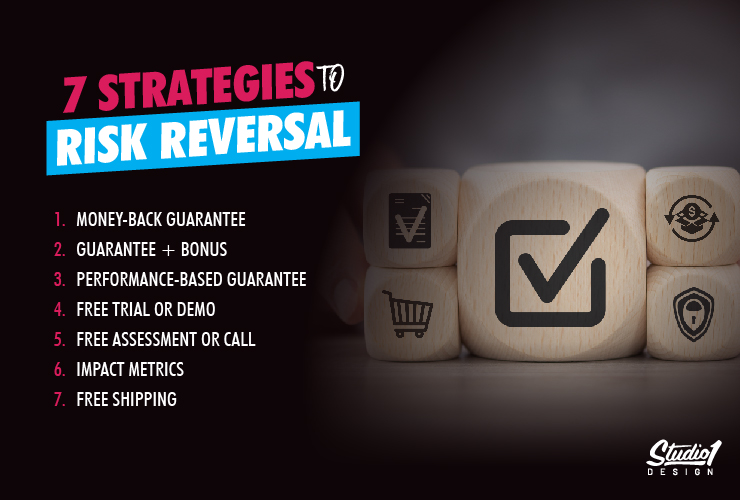

7 Strategies to Reverse Risk

1. Money-Back Guarantee

This is where you offer a refund like a 100% money-back guarantee if your customer finds out they don’t like your product after using it.

You may offer 30, 60, or 90 days full refund. Other businesses provide 365 days. Your choice depends on the situation of your business and your offer.

-

How to Communicate the Money-Back Guarantee

- Be clear and transparent about your money-back guarantee terms and conditions, so that your customers are fully informed about the eligibility requirements, the process for refunds, and any restrictions.

- Design a refund process that prioritizes customer convenience. For instance, allow customers to receive a full refund without the need to fill out lengthy forms or provide detailed explanations. This streamlined approach not only enhances the customer experience but also builds trust and loyalty.

-

Case Study:

SaxSchoolOnline.com offers a free trial and 90-day 100% refund guarantee which has added over 1000 new students!

2. Guarantee + Bonus

If you want to really stand up above your competitors, you may offer a bonus on top of the usual money-back guarantee. For example, if your customer is not happy with their purchase, you’ll give them a full refund, plus $100.

Again, for this kind of risk reversal, communicate it with clarity and transparency and consider customer convenience.

-

Case Study:

UnstoppableProsperity.com offers a free book plus 3 surprise bonuses, resulting in a 22% boost in conversions.

3. Performance-Based Guarantee

This type of risk reversal is common to service-based businesses. This approach instills confidence in potential clients and underscores your dedication to measurable outcomes.

Example: “We will help you increase your conversions by at least 3% or we will work for free until you do.”

-

How to Communicate the “Performance-Based” Risk Reversal

- Clearly state the performance goal (e.g., increasing conversions by a specific percentage) you guarantee to achieve. Define the conditions for the guarantee.

- Demonstrate commitment by offering additional free services if the goal isn’t achieved within the agreed timeframe.

-

Case Study:

Tom Breeze, founder of YouTube Ads Pro, doesn’t charge his clients unless he gets results for them. This guarantee has boosted his conversions.

4. Free Trial or Demo

Offering “Try before you pay” condition to your target customers significantly reduces buying friction, encouraging them to try your product without any upfront commitment.

This kind of risk reversal is common in the SaaS niche.

-

How to Communicate the “Free Trial” Risk Reversal

- Start by clearly stating the length of the free trial period and what features or services are included.

- Emphasize the ease of starting the trial, such as requiring minimal information and no credit card. Highlight the benefits users will experience during the trial, showcasing the value they can expect from your offer.

- Reassure potential customers that there is no obligation to continue after the trial period, making it a risk-free opportunity to evaluate your offering.

-

Case Study:

Since Clevero’s new website went live, it has had an increase in new leads because it now offers a free demo that makes prospects feel secure when looking for a new system to run their operations.

5. Free Assessment or Call

The goal of this risk reversal is to indirectly impress your ideal buyer on how helpful your offer is. It’s like giving them a glimpse of the value you can offer.

-

How to Communicate the “Free Assessment” Risk Reversal

- Explain what the free assessment includes and how it will benefit your potential customer. Highlight that the assessment is tailored to their specific needs, providing personalized insights and recommendations.

- Emphasize that this is a no-cost, no-obligation opportunity for them to understand the value your offer can offer. Demonstrate past successes or testimonials to build credibility and trust.

- Make the process easy to initiate, with minimal effort required from the customer. This approach allows potential buyers to experience the tangible benefits of your offering, increasing the likelihood of conversion without any upfront risk.

-

Case Study:

Thealangroup.com significantly boosted their conversions because they built trust with their prospects before the latter committed to a purchase.

6. Impact Metrics

These can include the number of years your business has been thriving, the amount of positive customer feedback, the number of satisfied customers served, and the quantity of products sold, just to name a few.

-

How to Communicate “Impact Metrics” Risk Reversal

- Determine which impact metrics are most relevant to your industry and business. These could include sales figures, growth rates, or market reach. Tailor your messaging to highlight these specific metrics.

- Present your impact metrics with supporting data and evidence. This could be in the form of graphs, charts, case studies, or testimonials. Providing concrete data helps build credibility and trust with potential customers.

- Explain how your impact metrics translate to tangible benefits for your ideal customers. For example, If you have sold a large number of products, you can highlight that this demonstrates strong market demand and product reliability, suggesting that new customers will be investing in a high-quality product.

-

Case Study:

GoldenMonk.com displays impact metrics on the homepage and product pages when we redesigned their entire website which helped boost its conversions by 43% in the first week.

7. Free Shipping

This eliminates a common barrier to purchase, reducing cart abandonment rates and increasing conversions. Customers are more likely to complete their purchase when they perceive added value without additional costs.

-

How to Communicate “Free Shipping” Risk Reversal

- Just clearly state you offer free shipping. To ensure free shipping is sustainable for your business, do your calculations. Understand how you will cover the expenses of offering free shipping and evaluate if it aligns with the current financial situation and goals of your business.

-

Case Study

Eheat.com offers free shipping, boosting its conversions by 12%.

How to find out which specific risk reversal you need

To determine the most effective risk reversal strategy for your business, start by analyzing the primary concerns and objections of your offer. Uncover their fears. Based on that, you’ll be able to identify the best types of risk reversal to overcome their objections. Test different risk reversal tactics to see which resonates best with your audience. Monitor the impact of each strategy on conversions, customer satisfaction, and return rates. Adjust and refine your approach based on real-world data to ensure you are offering the most compelling risk reversal options.

How to uncover your target customers’ fears

Consulting your customer service team can help identify the most frequent questions and objections they encounter. Your salespeople, who interact directly with customers, are also aware of their concerns and fears. If you don’t have a team, you can conduct surveys on forums and social media platforms to discover potential obstacles to your potential buyers’ purchasing decisions.

Bonus Things To Consider

Leveraging urgency can significantly enhance the effectiveness of your risk reversal strategy. By incorporating limited-time offers or exclusive deals, you create a sense of immediacy that encourages potential customers to act quickly, reducing hesitation and boosting conversions.

Additionally, it is crucial to regularly update your guarantees. Customer needs and market trends evolve, so periodically reviewing and refining your risk reversal policies based on feedback and current industry standards ensures they remain relevant and compelling.

Summary & Conclusion

Effective risk reversal strategies reduce target customers’ hesitation and increase their confidence in your offer. Clear and simple communication is key to ensuring customers understand and trust your guarantees. Regularly updating your risk reversal strategies based on customer feedback and market dynamics ensures they remain effective. Ultimately, implementing strong risk reversal tactics not only enhances customer loyalty but also strengthens your business’s competitive edge.

Ready to Boost Your Conversions with Risk Reversal?

If you’re looking to enhance your conversions and customer trust, without the hefty costs of traditional marketing agencies, feel free to book your free call with us, and let’s talk about how we can help you boost your conversions with our risk reversal strategies.

Leverage our expertise gained from designing thousands of successful websites.

Here are a few more awesome results from our clients…

Rippaverse.com created an opt-in page for people to be notified when Eric July’s first comic book was released. On the page, we showcased his impact metrics including his 100 million YouTube views. He collected over 100,000 new leads to create demand. Then within the first week of releasing his first comic book, he sold over $3 million worth of comic books!

EffortlessSwimming.com’s new website has doubled its sales from a combination of the new website, new copy, and running new ads.

PilatesJustForYou.com 6 months after their new optimized website went live, their business turnover increased by 30%, adding 26 new clients to their Pilates studio sessions.

If you want to achieve remarkable results for your business, book your free call with us and see how our tailored solutions can bring your business to a new level of success.